Why the Economy Grows Like Crazy Amid High Taxes

Read that. It's not long.

"The raw truth is that the economy has grown faster when taxes were higher, but how can we explain that phenomenon?"

Of course that is not the raw truth, but that's not the point. Empirically I can prove anything; what I'm interested in is their explanation. Let's get started, shall we?

"High marginal tax rates correlate with economic growth."

Examples are given. WW II and the Truman-Eisenhower years.I've talked about this before, but let's remember that WW II was a time of economic starvation. And besides, who cares about marginal tax rates? The actual amount of taxes paid is what matters. And as millionaire Peter Schiff has said, he'd rather have the Truman-Eisenhower tax code just because of all the deductions that existed back then. But even if these empirical cases were solid, it would still explain nothing. Empirically we can prove anything.

"Tax rate increases are followed by real economic growth."

Again, there are examples. Hoover in 1932, FDR in 1936 & 1940, Bush in 1991 and Clinton in 1993.I'm baffled. 1933 was possibly the lowest point in the entire Depression! And what exactly happened in 1937? Oh yes, there was the recession within the depression. And as we've already seen, WW II was not "real economic growth."

1991 was the bottom of a recession, so of course the economy would grow after that. The situation doesn't change in 1993. But what about the capital gains tax cut in 1997? Why isn't that mentioned?

"Large tax cuts are followed by a boom, a bubble and a crash."

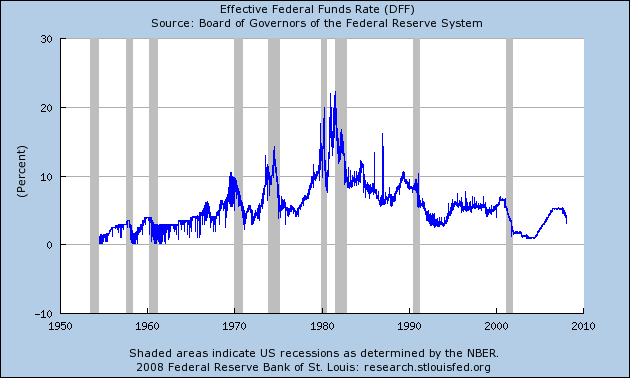

1929, 1987 and 2008 prove this. And here they even blame the 1982 recession on tax cuts.The 1982 example is especially funny. That recession started much earlier than 1982, so the timeline doesn't work. But maybe another explanation might be a decade of loose monetary policy followed by Paul Volcker's record-setting 20% interest rates.

Anyone remember the depression of 1920-1921? Of course you don't. The first year of that depression was much worse than the first year of the Great Depression. It was preceded by record-high marginal tax rates.

During that recession the government did not engage in monetary stimulus, it cut taxes and took an axe to the budget.

Usually this episode is used against Keynesians. They did the opposite of what Keynesians suggest and the depression went away. 10 years later they abandon laissez-faire completely and we get the worst economic disaster in US history. Keynesians aren't disturbed by this, since they can always say that the government didn't do enough until WW II(they still think WW II was an economic boom). But the 1920-1921 depression also doesn't fit the Alternet narrative about low taxes causing boom & busts.

Let's move to Reagan, the slasher of taxes(yes, this is sarcasm):

Reagan came into office proposing to cut personal income and business taxes. The Economic Recovery Act was supposed to reduce revenues by $749 billion over five years. But this was quickly reversed with the Tax Equity and Fiscal Responsibility Act of 1982. TEFRA—the largest tax increase in American history—was designed to raise $214.1 billion over five years, and took back many of the business tax savings enacted the year before. It also imposed withholding on interest and dividends, a provision later repealed over the president's objection.

But this was just the beginning. In 1982 Reagan supported a five-cent-per-gallon gasoline tax and higher taxes on the trucking industry. Total increase: $5.5 billion a year. In 1983, on the recommendation of his Special Security Commission— chaired by the man he later made Fed chairman, Alan Greenspan—Reagan called for, and received, Social Security tax increases of $165 billion over seven years. A year later came Reagan's Deficit Reduction Act to raise $50 billion.

Even the heralded Tax Reform Act of 1986 is more deception than substance. It shifted $120 billion over five years from visible personal income taxes to hidden business taxes. It lowered the rates, but it also repealed or reduced many deductions.

I've made my point. Empirically the case isn't nearly as solid as this article wants you to believe. In fact it's not solid at all.

Why do high taxes create a stronger economy?

Now they're gonna try and rationalize this. Hey, maybe it'll make sense?

"High taxes create an incentive to reinvest profits into long-term growth. With high taxes, the only way to retain the bulk of the wealth created by a business is by reinvesting it in the business."

Ok, so forced investments are apparently a good thing. I'd say that's immoral, but that's just me, right?Forget the morals; look at the results, man!

I'm looking and I see nothing.Let's suppose all profits are taxed at 50%. Let's suppose my profits are 1 000 000€. So right now I can get 500 000€ or I can reinvest (at most) the whole 1 000 000€. Ok great, but what is ultimately the only reason for reinvesting any of the profits? It's to make future profits... And those future profits are taxed at 50% just like current profits. Taxing profits lowers the present value of all investment projects because it lowers their expected net yields. Econ 101, anyone?

The entire argument is fallacious from beginning to end. Taxing profits does not result in more reinvesting. Even if it did, how is that a good thing? If profits are paid out as dividends then the recipients can not only spend that money, but they can also invest it some place else.This is much more efficient than locking the money in a single company.

Ok, now that the entire reason-d'être of this article has been destroyed, I won't waste my time taking the rest of it apart. Let me quote just one more thing:

"The point is that relying on the magic of the marketplace is like relying on any other kind of magic."

To ridicule the marketplace by calling it magic was a rather ironic choice. The things we currently take for granted would've been called magic or the work of god for most of mankind's history.Too bad people today can't see it.

No comments:

Post a Comment