Four Horsemen is a feature length documentary about the state of the world today. It combines interviews and narration to paint a rather bleak picture of the world.

It's a poorly written mess that doesn't tell a coherent story and is factually incorrect. It feels like it's directed by several different people, all of whom have a different story to tell. It covers a lot of topics, but none of them receive enough analysis. There is some good stuff here, but overall I can't recommend this.

So what are the four horsemen, exactly?

1) A rapacious financial system

2) Escalating organized violence

3) Abject poverty for billions

4) Exhaustion of the earth’s resources

And according to the movie governments, religion and mainstream economists have failed to offer any solutions.

Governments not only don't offer solutions, they actively promote all of these problems. The documentary partially acknowledges this.

I'm not going to touch the subject of religion. It's not even defined.

Quite a diverse group of economists can be categorized as mainstream. But later in the movie the focus is on neoclassical economists, Milton Friedman and the Chicago boys. So I guess those are the "mainstream" mentioned here?

I'm an Austrian, so I have major disagreements with the neoclassicals. But compared to what politicians and most non-economists think, they're brilliant.

"This is not a film that sees

conspiracies, it's not a film that mongers fear, it's not a film that

blames bankers or politicians. It's a film that questions the systems

we've created and suggests ways to reform them."

The movie starts off by telling the audience this bald-faced lie. Thank god it's a lie; otherwise the movie wouldn't really have any substance to it. This is some pretty schizophrenic writing. Maybe this part was supposed to be cut, but they forgot it in?

This movie talks about scary conspiracies and they directly blame Alan Greenspan for the housing bubble. You should call things for what they are. Sure, conspiracy is a loaded term these days, but have some balls and use it anyway! Greenspan's culpable, you say? Then blame him! You can blame the system, too. It's not like you can't do both. These "systems" were created by men, so indirectly you are blaming people anyway.

"Not only does the elite control the

money, they also control the cognitive map. In

this context what matters is not so much what is said in public, but

what is left undebated."

This is absolutely correct. It also sounds like a conspiracy to me. The movie (

just like I did) promotes the web as a great way to get around the gatekeepers of society. They encourage self-education and describe the economics taught in universities like this:

"Some of it is useful; the rest you should learn just to know your enemy."

Brilliant. I wholeheartedly agree.

The movie points out how mankind's ability to adapt is a major reason for how we can tolerate so much oppression. Again, I agree.

Lotsa bad...

Too bad the creators of this documentary know next to nothing about the history of economic thought. They offer us the

classical economists for our self-education... Ok guys, but what about the marginalist revolution? I'm ok with taking some policy recommendations from the French liberal school of the 19th century, but you can't use classical theory to defend these policies. Good policies can't be defended with bad theory, that's a recipe for disaster.

One of the worst parts of the movie comes when Friedman, Reagan, Thatcher and neoclassical economics are tied together with hyperbole and misinformation. It's the usual story: deregulation is the culprit. The only evidence offered is the so-called repeal of Glass-Steagall.

Too bad it had absolutely nothing to do with anything. I'm pretty sure Reagan and Thatcher were even shown as promoters of house ownership. They might've been, but it's a joke compared to what Greenspan, Clinton and Bush did. Also, the writers didn't bother to research what trickle-down economics is, so instead they strawman it. Good job, guys!

Noam Chomsky's tale of Friedman, Chile and Pinochet was apparently meant to be dramatic, but I found it hilarious. In 1973 Augusto Pinochet overthrows Salvador Allende's democratically elected government, becomes a dictator and is adviced by none other than Milton Friedman! But Pinochet was far better than Allende, dictatorship was far better(proof: they elected Allende) than democracy and Friedman's advice was far better than that of the socialists. Had Allende's and Pinochet's roles been reversed; today's intellectuals would celebrate what happened. But they can't, because the socialists lost.

...some good.

When Darek El Dawiny talks, you listen. Ok, so the movie's got a section on banking. Everybody hold your breath, because...

They fucking nail it. Fractional-reserve banking is described as fraud, they explain Cantillon effects, they point out that it's a transfer of wealth from everybody else to the banksters and politicians, they suggest it can create bubbles and they point out that it causes income inequality. They ridicule the cost-push explanation of inflation and so on.

This is by far the best part of the whole movie. They don't go into much monetary theory, but they don't need to. It's simple, concise and correct. Earlier they even point out how monetary debasement is a crucial part of an empire in decline.

The documentary aptly points out how the IMF, the World Bank, government foreign aid and other such institutions are really nothing but corporatism in disguise. Nice catch, guys.

Changing gears...

Remember how I said this movie was a mess? Well, here it comes.

Michael Hudson and George Nilson, a Baltimore City lawyer; get interviewed about how terrible the banks were. Hudson says the bankers were racist. A black male foreclosure victim gets interviewed about how it all went to hell. Nilson blames Wells Fargo. Wells Fargo was really evil, because they offered these subprime ARMs to people. Everything was going fine, until the great evil came and foreclosed on everyone. A black female gets interviewed this time. No offense and all, but she looks subprime to me. This is Baltimore. I've watched The Wire.

Harr harr harr...

All joking aside; the borrowers are subprime, not the lenders. These borrowers don't qualify for non-subprime loans, so blaming Wells Fargo for this is rather odd. The narrator mentions predatory lending and about some complicated small print that tricks people. Nilson's story makes no sense. He's blaming Wells Fargo for the inability of the borrowers to pay. He sees foreclosure as the problem, not the fact that people bought overpriced real estate. This whole segment is utter nonsense.

Then the narrator asks: Is it really about racism? Maybe it's just about making money? Ok, if it's about making money then why the hell did you just waste our time with those interviews about racism? The following things were not mentioned:

1) Wells Fargo lost a fortune because of those subprime loans and was bailed out.

2) The Community Reinvestment Act encouraged these kinds of subprime loans.

3) Fannie Mae and Freddie Mac were the biggest buyers of subprime on the planet.

4) Other harmful interventions in the housing and mortgage markets.

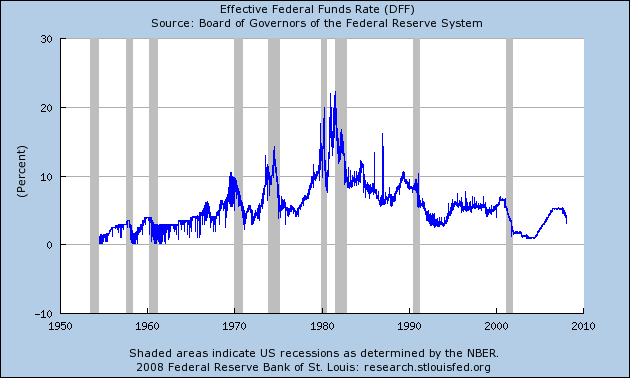

The movie blames low interest rates for the bubble, but in this segment they seemingly forget all about it. This is some convoluted stuff right here.

...to Full Retard

We're running out of natural resources and space, our current system has to have growth and consumerism, we don't really want this stuff we buy and the more we grow the more poverty and moral decay we create. Satish Kumar's comments were especially bad.

The writers ran out of ideas apparently, so they decided to throw every anti-capitalist fallacy out there into the movie. Logic and the reality around us immediately tells us these are fallacies, and the creators didn't even present these ancient arguments in any creative way. This is the

Affluent Society on steroids.

Herbert Spencer and the survival of the fittest was mentioned, too.

Thank god for David Gordon.

Solutions

Finally; the part everyone's waiting for... The end of the movie. Here we are presented with ways to fix our problems.

The first step towards solving our problems is... the gold standard. What?! They got it right, amazing. They even gave the right reason for why gold would be good money(its amount is not controlled by politicians). Looking good!

Then we... forgive all debts. Certainly you should repudiate the national debts; they're illegitimate. But don't just cancel all private debts, that's pretty nuts. The German Miracle after WW II apparently proves that this can work. I'm pretty sure all private debts were not cancelled in Germany. Not to even mention that the real reason for the German Miracle was the abolition of price controls. Cancelling private debts would mean wiping out the saver. An economy is built on savings, so this is quite a self-destructive policy.

Then we tax... consumption instead of production. Too bad this is impossible.

And this is why Rothbard was a genius:

Hence, the seemingly common-sense view that a retail sales tax will

readily be shifted forward to the consumer is totally incorrect. In

contrast, the initial impact of the tax will be on the net incomes of

retail firms. Their severe losses will lead to a rapid downward shift in

demand curves, backward to land and labor, i.e., to wage rates

and ground rents. Hence, instead of the retail sales tax being quickly

and painlessly shifted forward, it will, in a longer run, be painfully

shifted backward to the incomes of labor and landowners. Once again, an

alleged tax on consumption, has been transmuted by the processes of the market into a tax on incomes.

But then we find out that specifically we're supposed to tax land. Rising land values are a free lunch that land-owners earn in their sleep, so why not? But doesn't that apply to quite a lot of things? My stocks/bonds/anything go up in price when I'm asleep. I just had to own them, nothing more. Why is land different?

They also argue that natural resources weren't made by anyone, so the rents earned from them should be a good target for taxation. But humans do not create anything physical. Production is not creation, it's transformation. A diamond mine produces diamonds. A jeweller then produces diamond rings. Both production processes are about transforming something so that it becomes more valuable. But somehow we're supposed to believe that the diamond mine should be taxed, while the jeweller probably shouldn't. They drew an arbitrary line between different stages of production and tried to rationalize it. They failed.

But it doesn't end there! Taxing natural resources also means we'll use them more efficiently. Let me translate that: We'll use

less of them. Human action is purposeful behavior, so we do indeed allocate available resources to our most highly ranked ends. If we have less of something; its marginal utility will be higher. To put it another way: We restrict the supply and as a result the price will rise. Any good welfare analysis would tell us that this is harmful to human well-being. But if you still don't get it, let me reductio ad absurdum it for you:

Let's socialize the production of food and create a famine. Do you have any idea how efficiently people would use food? Avoiding death by starvation is probably ranked very high on people's value scales, so almost every unit of food used would satisfy this highly ranked end. On the other hand right now a much smaller portion of the food eaten in modern capitalist countries is solely to avoid starvation. It's inefficient, because food is being used to satisfy wants that are less highly ranked. In fact, this should be North Korea's new slogan:

Welcome to the land of efficient food usage.

This thing is going downhill and fast. Now it's Noam Chomsky's turn to give confusio... I mean solutions. 19th century workers took it for granted that they should own the mills and factories they worked in. Wage labor was seen as hardly different from slavery. Lincoln and the Republican Party of the 19th century believed in this, too.

Ok, but Lincoln and the Republican Party were the bad guys. Why would we listen to them? And why is employee ownership a good thing? I mean there are a thousand good reasons for why employee ownership is inefficient, but none of them are mentioned here. There still are many businesses that are owned by the workers themselves, but without a few exceptions they simply can't compete with other forms of organization. I certainly wouldn't want to be a co-owner at the place I work at. What if shutting down the business or drastically downsizing was the best thing to do? That's a lot of potential bad blood right there, and nobody wants to decide on which co-worker to fire.

Then some of the interviewees give a completely out-of-place shoutout to the market economy. Right after that, a critic of the market; Ha-Joon Chang from Cambridge, tells us that it's ridiculous to claim that there's a scientifically defined boundary of the market that we should never change. Fair enough, but then he adds that this is exactly what the free-marketeers would want you to believe. I've read my fair share of free-market economists, and I've yet to encounter someone who tries to use economic science to show that there exists a mythical boundary like this. Economics is descriptive. Chang is talking about normative statements.

Chang continues: Politics is about limiting the scope of the market. That's correct, politics is about voluntary interactions being replaced by aggression. Chang gives two examples of how we've limited the scope of the market during the past 200 years. We can no longer sell and buy people(slavery) and we can't sell and buy child labor. Let me make one point very clear. Slavery is not a market institution. Tautologically you could say that slavery is by definition anti-market. But on top of that slavery is immensely inefficient, so on a free market it would wither away. To a layman that may not make sense immediately, but the

theoretical and empirical evidence speak for themselves:

The price paid for

the purchase of a slave is determined by the net yield expected from

his employment…just as the price paid for a cow is determined by the

net yield expected from its utilization. The owner of a slave does not

pocket a specific revenue. For him there is no "exploitation" boon

derived from the fact that the slave's work is not remunerated…. If

one treats men like cattle, one cannot squeeze out of them more than

cattle-like performances. But it then becomes significant that man is

physically weaker than oxen and horses, and that feeding and guarding a

slave is, in proportion to the performance to be reaped, more

expensive than feeding and guarding cattle…. If one asks from an

unfree laborer human performances, one must provide him with

specifically human inducements. If the employer aims at obtaining

products which in quality and quantity excel those whose production

can be extorted by the whip, he must interest the toiler in the yield

of his contribution. Instead of punishing laziness and sloth, he must

reward diligence, skill, and eagerness.… It is this fact that has made

all systems of compulsory labor disappear. (Human Action 3rd edition, pp. 630—631)

I know the inefficiency of slavery doesn't sound convincing to everybody. I didn't realize it until Robert Murphy explained it in one of his numerous talks on YouTube. But once you grasp the logic behind it; it becomes clear as day.

Child labor was eradicated by market forces, pure and simple. As society became wealthier, more and more people could comfortably afford to not have their children work.

I highly recommend this article by Jeffrey Tucker. Most child labor laws are harmful.

There's hope!

I do agree, all is not lost. A peaceful revolution of ideas might save us. The documentary gives us some examples of how this was done in the past.

1) Andrew Jackson beat the 2nd Bank of the United States in the 1830s.

This indeed was a great moment in US history. Banksters and politicians were using this bank to rob the public. Ending it was a victory for freedom and human welfare.

A curiousity I noticed: The Finnish subtitles did not say "2nd Bank of the United States," but "the second-largest bank in the US." An understandable mistake, but it certainly alters the meaning.

2) Teddy Roosevelt beat Rockefeller and J.P. Morgan.

Teddy's trust-busting did indeed mess with Standard Oil and the Northern Securities Company.

I've already dealth with Standard Oil and the mythology of monopolies. Standard Oil(i.e. Rockefeller) was probably targeted because J.P. Morgan asked for it.

The Northern Securities case doesn't make much sense, since Teddy was a Morgan man from the very beginning. It might've been a distraction, since in the end James J. Hill and the Morgans didn't lose much(i.e. they weren't harmed as much as the Rockefellers). Teddy was, as Mark Twain put it; "clearly insane," so that might be one explanation.

Just listen to this:

Thus, in 1905 Roosevelt was prepared for a direct confrontation with

China when that country cancelled a railroad concession it had granted

to J.P. Morgan. It was not without reason that the Chinese ordered the

cancellation: in five years Morgan had completed a mere 28 miles of what

was ultimately supposed to be an 840-mile track, and they also claimed

certain violations of contract on his part. Morgan himself, perhaps

recognizing the flimsiness of his case, accepted the settlement, which

included a handsome compensation package for profits foregone.

Roosevelt, on the other hand, was furious. He later remarked privately

that if Morgan had decided to fight, "I would have put the power of the

government behind them, so far as the executive was concerned, in every

shape and way."

The documentary manages to paint a picture of good ol' Teddy fighting big money on behalf of the little guy. What a joke.

3) Franklin D. Roosevelt beat all of Wall Street.

So I'm guessing it's pure coincidence that both the

Rockefellers and the Morgans got what they wanted? The Roosevelt mythology just won't die.

The movie ends with a quote from Victor Hugo:

No army can stop an idea whose time has come.

Good quote. The music during the credits was good, too.

I guess that's all.